Here you will be registering the Usernames and Passwords for each

GSTN.

Only after this you can onboard.

At the Government Portal, you will need to enable & register each

GSTIN

of your Company. For each GSTIN, you will get a User Name and

Password.

Please make a note of these, as they will be needed in the next step

for

Onboarding.

STAGE 1 - Enabling GSTIN for e-Invoice

(If you know that GSTIN is already enabled for e-Invoicing, you can

skip to STAGE 2 below)

Step 1: Click on the "Go to Govt Portal" button

below. You will get redirected to the Govt Portal in a new browser

Tab. When required, come back to the present Tab to refer to

step-by-step instructions.

Step 2: At the Govt Portal, click on menu

‘Registration’ and select ‘e-invoice Enablement’ from the drop-down

list.

Step 3: Enter the GSTIN and characters shown in the

image (CAPTCHA)

If the GSTIN is already enabled for e-invoicing, the message ‘3063 –

You are already enabled for e-invoicing". If so, skip to STAGE 2 for

this GSTN.

Step 4: Click the check-box and the button, ‘Send

OTP’.

OTP will be sent to the registered mobile number. Enter the OTP to

enable e-invoicing.

Repeat above Steps above for each GSTN

STAGE 2 - e-Invoice Registration

Step 1: At the menu ‘Registration’ in the Govt

Portal, select ‘Portal Login’ from the drop-down list.

Step 2: Enter appropriate GSTIN, CAPTCHA and click

"Go". Now, the screen will display the details that were already

entered while enabling the GSTIN for e-Invoicing.

Step 3: Verify above details and click ‘Send OTP’.

Step 4: Enter OTP and click on "Verify OTP"

Step 5: After verifying the OTP, you will be asked

to enter a username and password to create your login

credentials. Confirm and save the details.

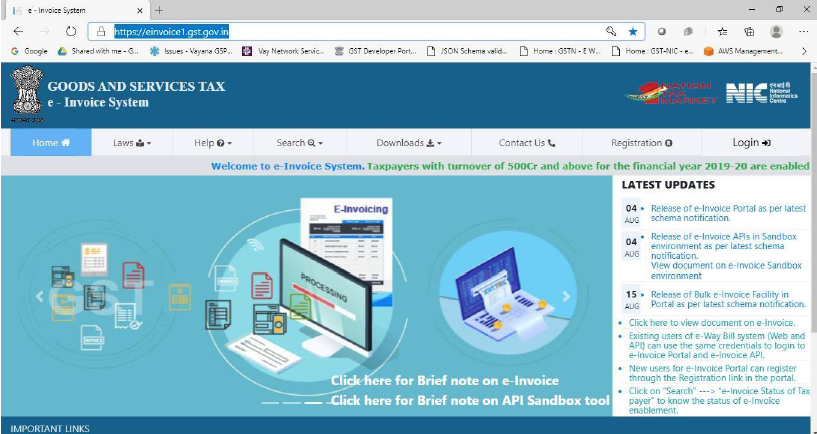

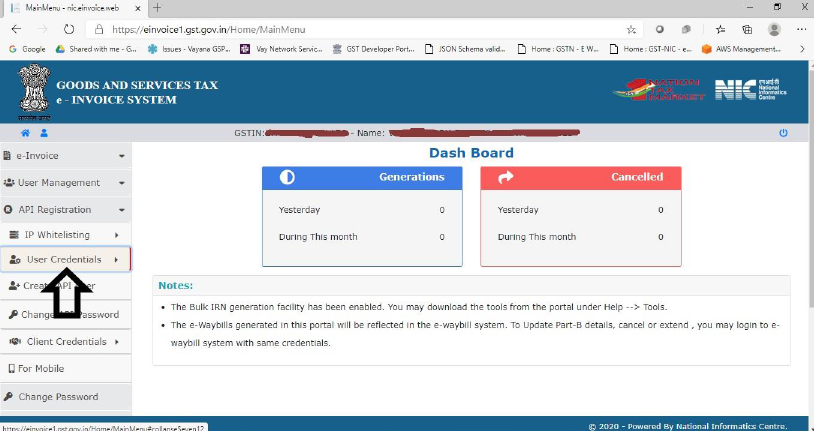

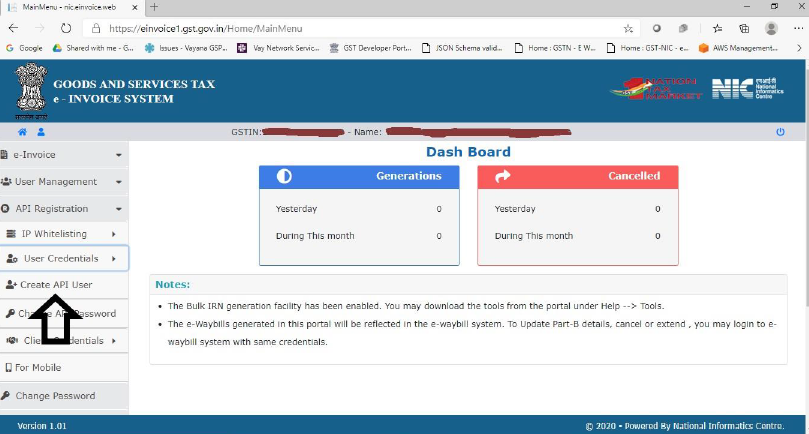

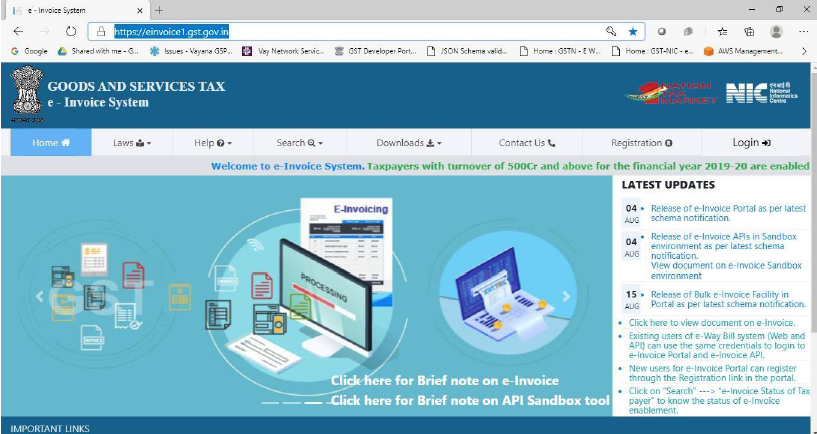

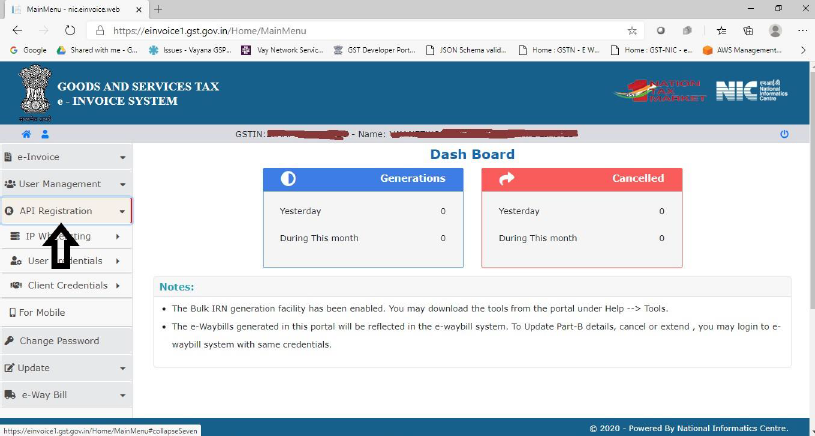

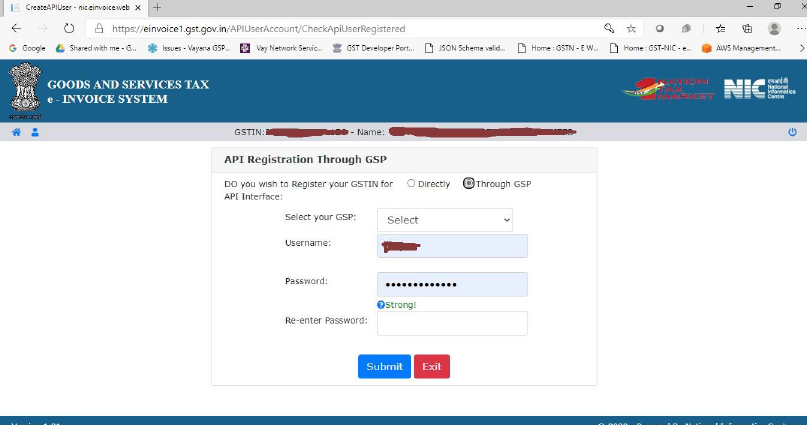

STAGE 3 - IRP Registration

Step 1: Login to NIC E-Invoice Web Portal on -

https://einvoice1.gst.gov.in/

Step 2:

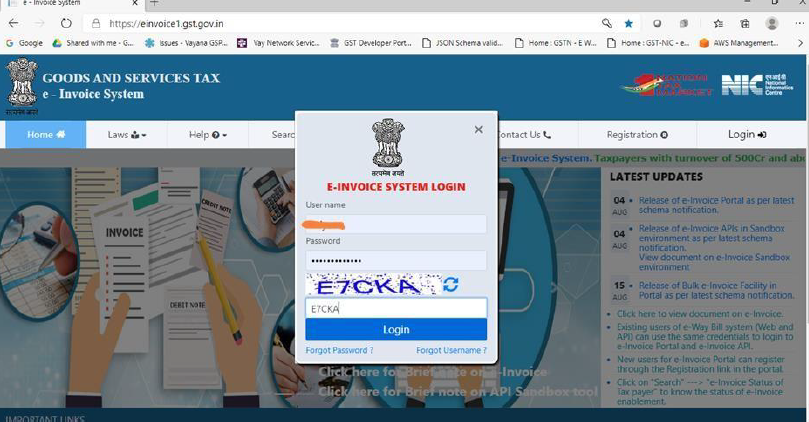

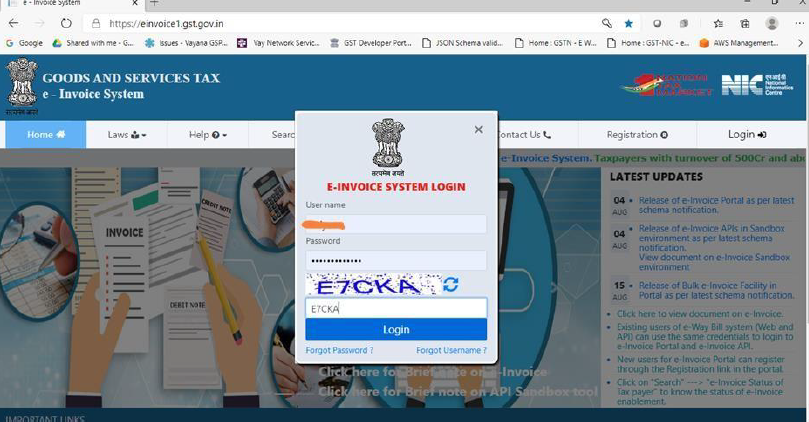

Step 2: Click on Login and enter your Username and

Password.

Step 3:

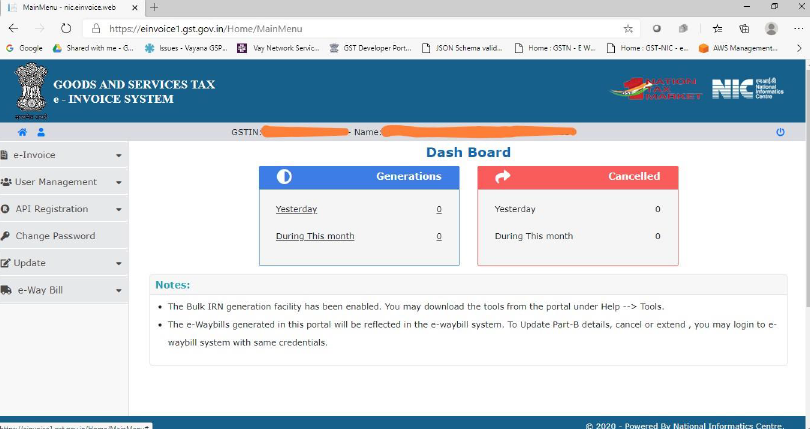

Step 3: You will be able to see below screen after

login.

Step 4:

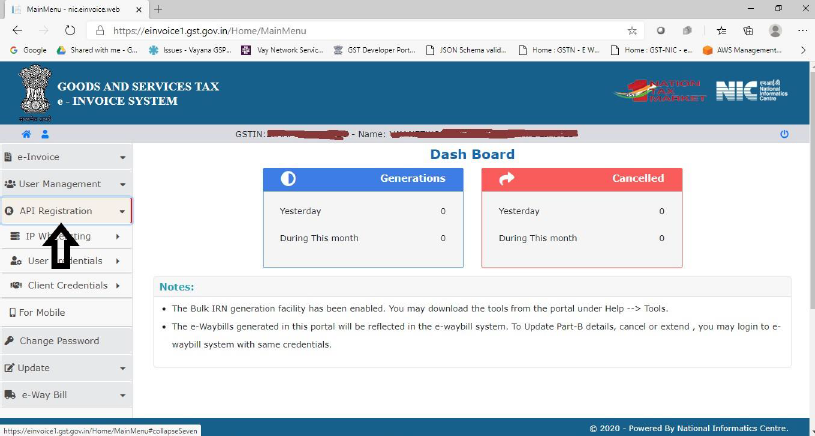

Step 4: Click on “API Registration”.

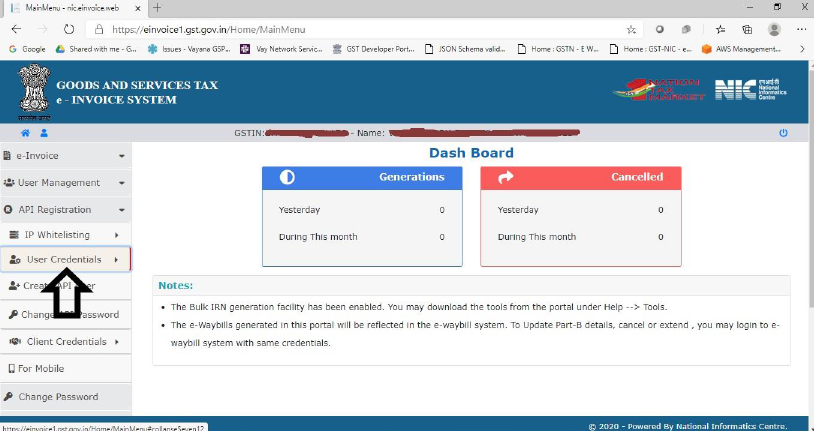

Step 5:

Step 5: Click on “User Credentials”.

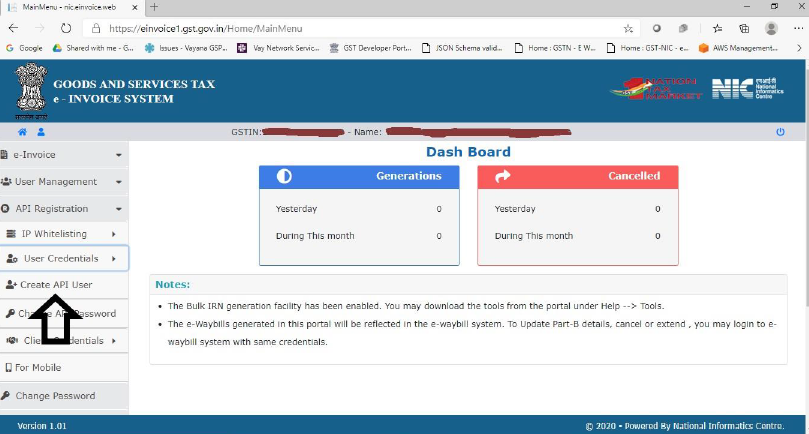

Step 6:

Step 6: Click on “Create API User”.

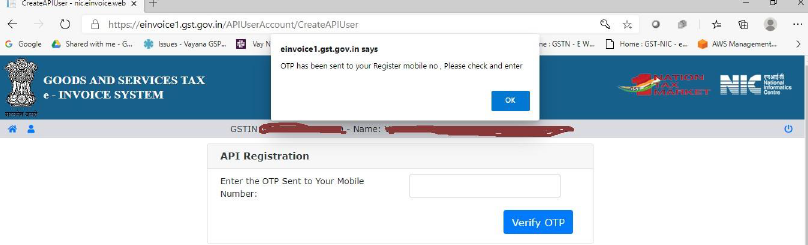

Step 7:

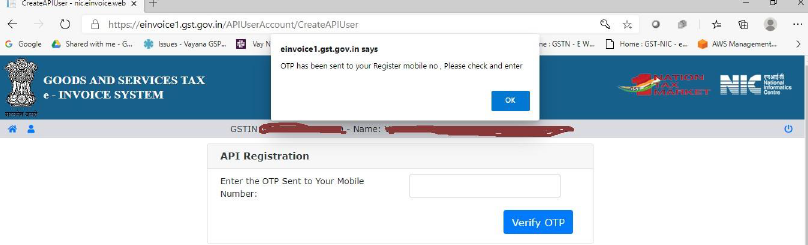

Step 7: It will trigger an OTP to your registered

mobile Number.

Step 8:

Step 8: Please enter OTP and click on Verify OTP.

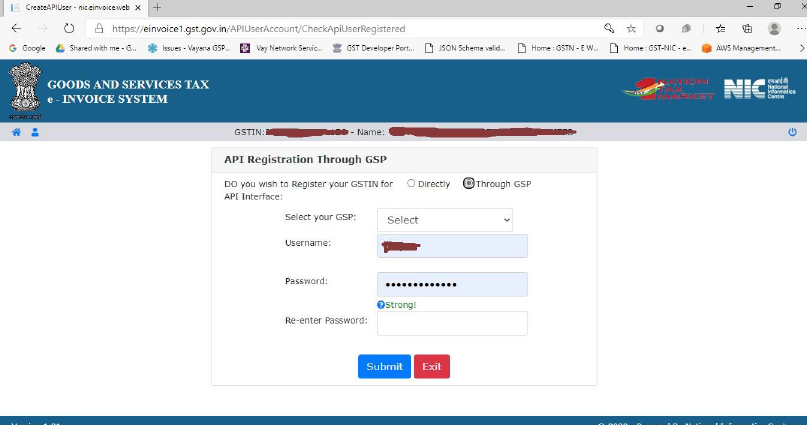

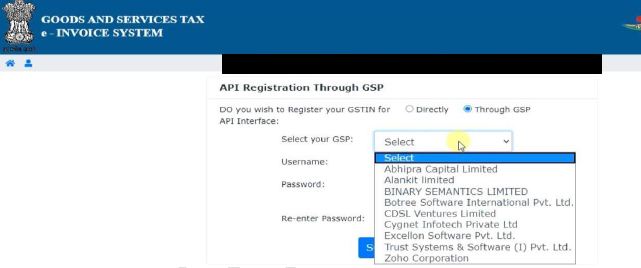

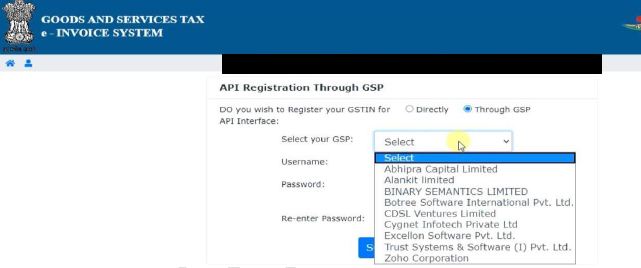

Step 9: Click on “Through GSP”.

Step 10:

Step 10: Select “Excellon Software Pvt. Ltd.” as

your GSP.

Step 11:

Step 11: Create API specific Username and Password

& Click on Submit.

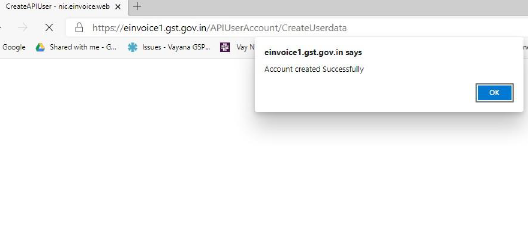

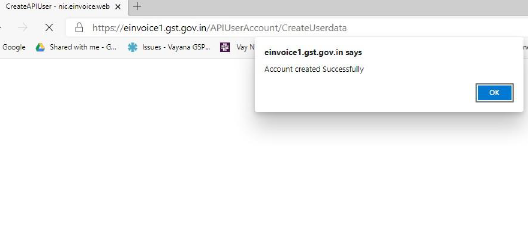

Step 12: Please confirm acknowledgement from

E-Invoice System.

After the above is done for all GSTINs come back to this Tab to

complete the onboarding

After the above is done for all GSTINs come back to this Tab to

complete the onboarding